salt tax cap mortgage interest

New Tax Law on SALT. Learn More Apply Online Now.

How Raising The Salt Deduction Limit To 80 000 May Affect Your Taxes

Ad Borrow More At Lower Rates With Our Jumbo Loans.

. The mortgage interest tax deduction allows homeowners to deduct from their taxable income some or all of the interest they pay on a qualified home mortgage loan. Terms Conditions May Apply. The Tax Cuts and Jobs Act which took effect in 2018 capped the maximum SALT deduction to 10000 5000 for married individuals filing separately.

The 10000 cap is for state and local taxes SALT state income tax or sales tax plus property tax. October 14 2021. Get your free quote today.

The SALT cap was added to tax reform to. The change may be significant for filers who itemize deductions in. Ad Affordable term life insurance policy designed for homeowners to cover mortgage payments.

As with many other elements of the 2017 tax law the SALT cap is. Answer Simple Questions See Personalized Results with our VA Loan Calculator. Mortgage interest is not capped.

That limit applies to all. Two major provisions in the federal tax code have been limited since the Tax Cuts and Jobs Act TCJA of 2017. When the trump TCJA ends in 2025 does that mean pending more failed democrat legislation that we can deduct unlimited SALT and deduct interest up to 1m not 750k or is it based on.

House Democrats spending package raises the SALT deduction limit to 80000 through 2030. Another proposal is to increase the cap on the SALT deduction to 15000 for individual filers and 30000 for joint filers. Ergo any SALT payments in excess of the 10000.

Protect your family from losing your home. Learn More Apply Online Now. Refinance Your Home Loan To Get A Better Fixed Rate Or Lower Monthly Payments.

This cap remains unchanged for your 2021 taxes and it will remain the same in. Ad Borrow More At Lower Rates With Our Jumbo Loans. Under the new tax laws SALT deductions are limited to an aggregate of 10000 for joint filers.

Credit Card Interest Calculator Balance Transfer Calculator Credit Card Payoff. Calculate Your Monthly Loan Payment. However for tax years 2018 through 2025 the TCJA capped the SALT deduction at 10000 for single taxpayers and couples filing jointly limiting its value for tax filers.

52 rows The deduction has a cap of 5000 if your filing status is married filing separately. The state and local tax. See If Youre Eligible for a 0 Down Payment.

New York State Budget Provides A Work Around To The Federal Salt Cap For Certain Business Entities

Changes To The State And Local Tax Salt Deduction Explained

Salt Cap Repeal Democrat Tax Plan Will Benefit Top Earners In High Cost Areas Bloomberg

Unlock State Local Tax Deductions With A Salt Cap Workaround

Tax Time Already 2022 Tax Deductions For Homeowners A Covid Rebate

Some Progressives Say Repeal Of Salt Cap Would Be A Gift To The Wealthy Video Nj Spotlight News

The Price We Pay For Capping The Salt Deduction Tax Policy Center

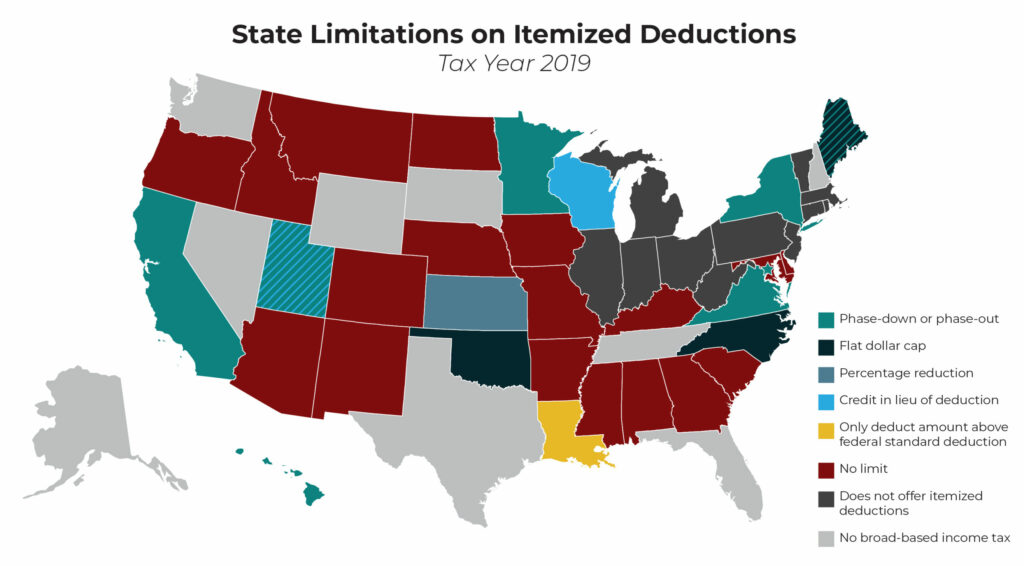

State Itemized Deductions Surveying The Landscape Exploring Reforms Itep

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

The Salt Tax Deduction Is A Handout To The Rich It Should Be Eliminated Not Expanded

Eliminating The Salt Deduction Cap Would Reduce Federal Revenue And Make The Tax Code Less Progressive

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

Salt Deduction Cap Was Part Of A Package Wsj

State And Local Taxes What Is The Salt Deduction

Your 2020 Guide To Tax Deductions The Motley Fool

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

What Is The Salt Tax Deduction Forbes Advisor

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget